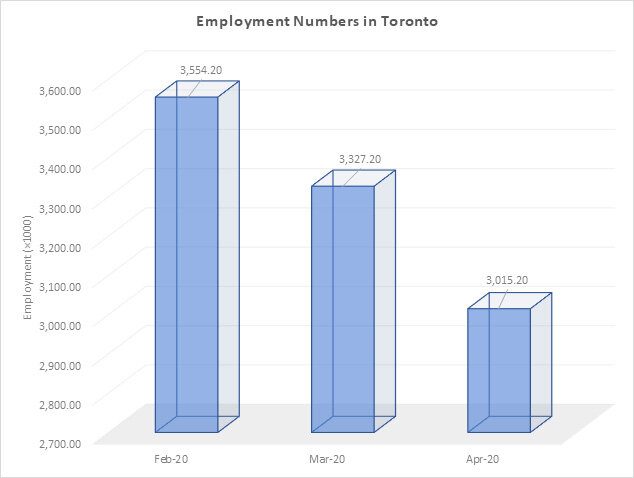

The latest Labour Force Survey (LFS) numbers are staggering but not as bad as economist’s have predicted. Employment losses related to COVID 19 and government-imposed business closures designed to slow it, cost Toronto Region over half a million jobs.

Statistics Canada’s April LFS is the first jobs report from the agency to offer a picture of the economic devastation in Toronto. In April, the unemployment rate in Toronto (11.1%) increased by 5.6 percentage points compared to the unemployment rate before the pandemic (5.5%). If anything, the unemployment rate is understated with a significant number of people not counted as unemployed since they were not looking for work given the economic climate and health concerns.

As TD Economics recently noted, we are in completely uncharted waters. Fortunately, timely federal and provincial measures are helping to ease some of the pain of lost income, and are likely to support employer-employee relationships, ideally speeding up the eventual return to work.

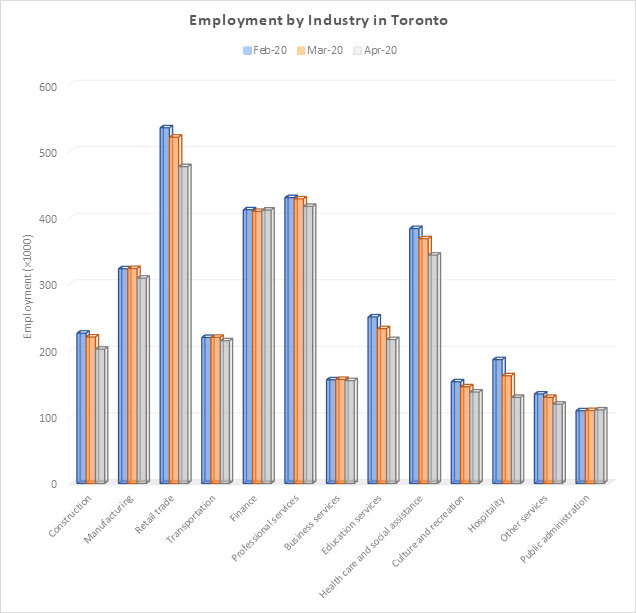

Job losses were felt across most industry sectors in Toronto. Hospitality saw an employment decline of over 30%, while educational services declined by 13% and retail by 11%. Manufacturing, financial and transportation saw much smaller declines, however some economists are worried that bigger losses will be seen in May’s labour force numbers and may already be evident in the job posting data.

There are some encouraging signs. Toronto – when compared to similar municipalities, has shown some resilience in its labour market. Of Canada’s three largest metropolitan areas, Montréal recorded the largest decline in employment at 18.0%; followed by Vancouver at 17.4%; and Toronto at 15.2%.

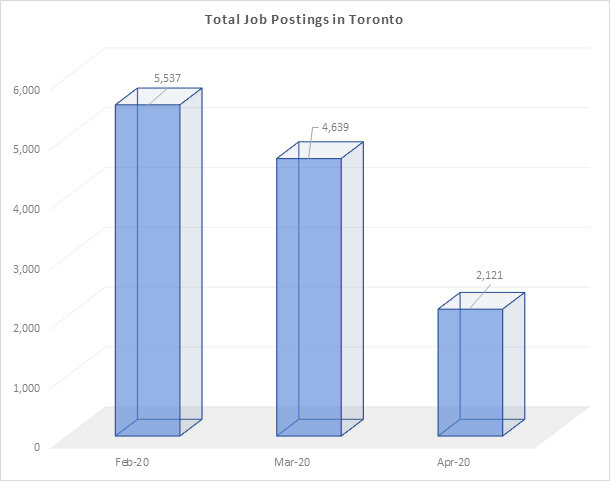

Job posting data also demonstrates some of the headwinds facing Toronto’s job market. As a proxy measure for future employment activity, there were over 3,000 fewer job postings in April when compared to February of this year.

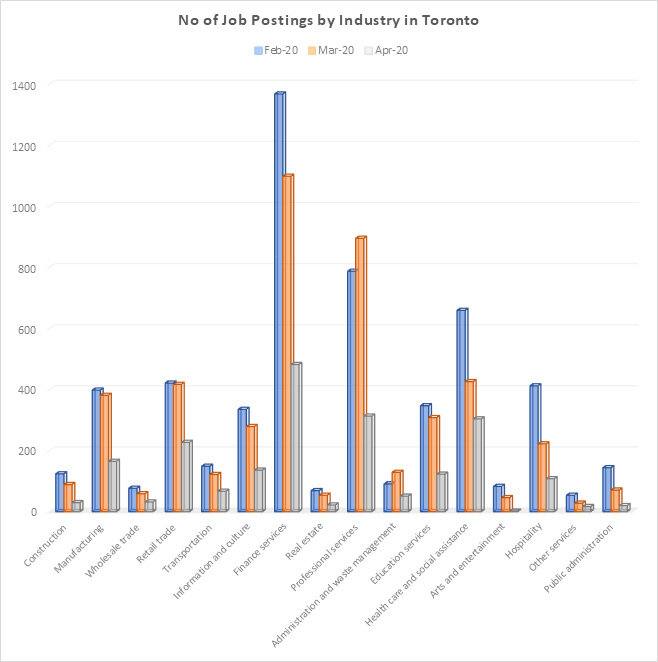

A closer examination of job posting data indicates that there was a significant decline in businesses looking for employees in finance and professional services – two industries that had seen fewer employment declines in the LFS. Other industries that saw significant decline in job postings were hospitality, health care and social assistance and manufacturing.

What can we tell a job seeker? Is there a reason for hope in the labour market? We are also seeing some encouraging signs in the recent tapering off in CERB applications, and both the Province of Ontario and the City of Toronto are in the midst of gradual re-openings. While optimism is hard, there is reason to be somewhat optimistic that the worst may be behind us.

Over the coming months as our economy gradually re-opens, the Toronto Workforce Innovation Group is going to closely monitor the job market and regularly update job market data to inform – what Toronto industries are rebounding the quickest? What types of employers are looking for workers? Answers to these questions can help Toronto’s economy benefit in post-COVID world.

For more information

Contact: mahjabeen@workforceinnovation.ca