Toronto’s Labour Market Rebounds in June.

Employment Trends

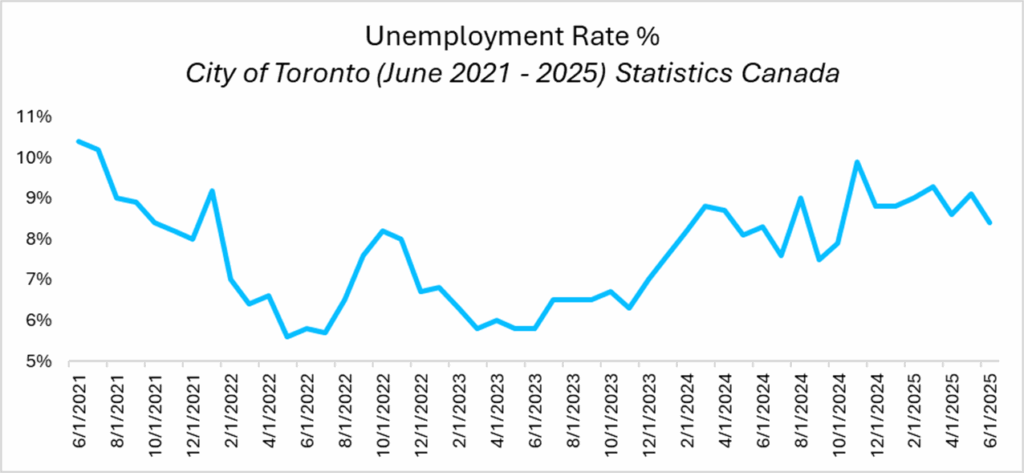

Toronto’s labour market showed a welcome improvement in June 2025. The unemployment rate fell to about 8.4%, down from 9.1% in May, marking the first decline in several months as employers ramped up hiring into the summer. This drop comes even as more people entered the labour force: the participation rate ticked up to 68.8% (from 68.2% in May) and remains about 3.2 percentage points higher than a year ago, reflecting a swelling pool of job seekers. Likewise, the employment rate rose to 63.0%, a full point higher than in May and well above last June’s 60.2%, meaning a greater share of Torontonians are working. In short, the city added jobs at a healthy clip in June, enough to bring down unemployment despite continued population growth. Total employment in the Toronto CMA now stands around 3.77 million, roughly 2% higher than a year ago. This resurgence in hiring suggests the local economy is gaining momentum after a cautious spring.

Even with June’s gains, Toronto’s jobless rate remains significantly higher than the provincial and national averages (Ontario’s around 7.5–7.8%, Canada 6.9%). The gap underscores that Toronto is still contending with more labour market slack than other regions. Some of this can be attributed to the city’s strong labour force growth and continued immigration, more residents are looking for work here than elsewhere. The U.S. tariffs implemented earlier in the year continue to cast a shadow: trade-oriented industries have been hiring cautiously, and uncertainty around cross-border business lingered through June. However, the full impact of these trade restrictions has yet to fully materialize. For now, Toronto’s labour market appears stabilized but fragile.

Toronto Wages: Modest Growth

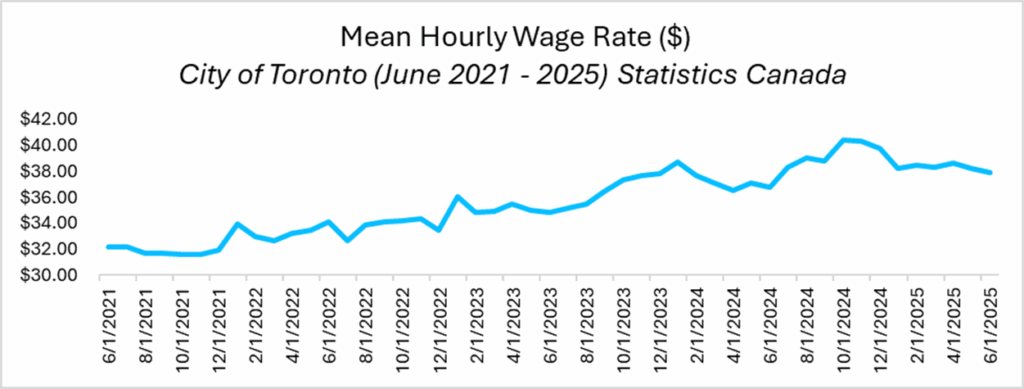

Wage trends remained relatively stable in June. The average hourly wage in Toronto was about $37.9 for June 2025, a slight dip from May (when it was roughly $38.7) but still approximately 3% higher than a year ago. This modest year-over-year gain indicates steady wage growth despite recent economic headwinds. Notably, Toronto’s wages continue to outpace both provincial and national norms. The city’s $37.9 hourly average compares to roughly $36.0/hr nationally and around the mid-$37 range in Ontario. This sustained wage premium roughly 6–7% above the Canadian average reflects the high concentration of skilled, high-productivity jobs in Toronto (in sectors like finance, tech, and professional services) and the city’s elevated cost of living, which puts upward pressure on pay.

While wages here remain well above the Canadian benchmark, the pace of increase has cooled slightly from the rapid gains seen previously. Certain industries, notably finance and insurance, continue to compete for talent with attractive compensation, helping sustain overall wage growth. For workers, these steady pay gains are a positive sign for purchasing power at a time when the cost of living remains a concern.

Sector Performance – Services Lead Gains, Goods and Trade-Sensitive Sectors Lag

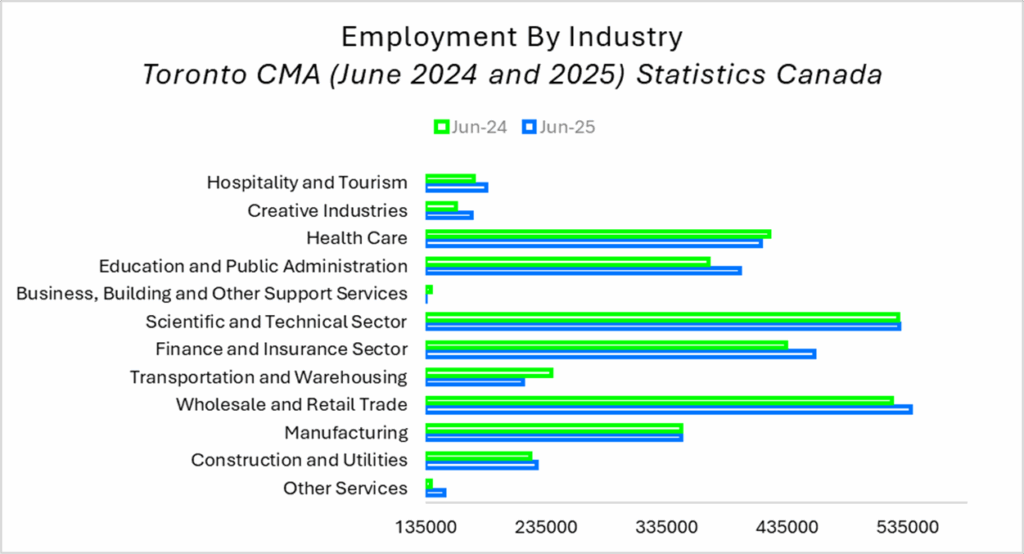

Toronto’s sector-by-sector employment trends for June 2025 paint a picture of an uneven recovery. Many service-oriented industries have expanded significantly over the past year, while several goods-producing and trade-sensitive sectors have struggled or stalled. The U.S. tariff war and interest rates continue to influence this split. Here’s how key sectors are faring, based on year-over-year performance:

- Hospitality and Tourism: The post-pandemic rebound endures, albeit at a calmer pace. Hotels, restaurants, and entertainment venues saw employment surge about +6.1% over the past year, totaling approximately 185,600 jobs in June. This reflects sustained recovery in travel, dining, and live events, following last summer’s hiring ramp-up. The sector is still rebuilding from its 2020–2021 lows, and while total employment hasn’t fully returned to pre-pandemic peaks, the continued year-over-year gains indicate a solid tourism revival. Seasonal summer staffing boosted this sector, though many businesses have now filled the roles.

- Creative Industries (Arts, Culture, Media & Recreation): Employment in Toronto’s creative sector grew by roughly +8% compared to last year (about 173,000 jobs in June). This is an acceleration from earlier in the spring. Film, arts, and live entertainment production have ramped up, contributing to the gains. The growth here underscores the cultural sector’s ongoing growth (including the opening of Rogers Stadium in Downsview Park), though funding and attendance levels remain factors to watch.

- Health Care: Slight contraction continued in health-related fields. Health care and social assistance employment in June was about 413,900, roughly –1.5% below last June’s level (420,000+). This is a somewhat smaller drop than observed in May (which was –2.2% YOY) but still indicates that health employment is not keeping up with demand. This paradox – chronic demand for healthcare services but flat or declining employment – can be attributed to workforce challenges. Hospitals and clinics are facing worker burnout and retirements, and hiring hasn’t fully caught up. There are ongoing shortages of nurses and personal support workers, yet filling those roles takes time due to training lags and budget constraints. The province has announced new measures (e.g. funding to expand nursing programs and accelerate training) to address this gap. As those initiatives take effect (see “In Other News”), we may see health employment rise. For now, the slight year-over-year dip suggests the sector is treading water – demand is high, but staffing has only recently started to ramp up to meet it[JM1] .

- Education and Public Administration: This broad category saw about +7.0% more jobs than a year ago, totaling approximately 396,000 workers. Schools (from K-12 to postsecondary) and government agencies have added staff over the past year. It’s worth noting June’s headcount is slightly below May’s likely a seasonal effect as the academic year end saw some short-term education jobs pause, but year-over-year growth remains robust. Public-sector hiring has provided a steady backbone for Toronto’s job market.

- Business, Building and Other Support Services: This category (which includes administrative support, building maintenance, call centres, waste management, etc.) has weakened further. Employment is down about –5.4% from a year ago, to roughly 131,800 jobs. In May it was down –3.4%, so the decline deepened in June. Earlier in the year this sector had been growing, but now it has slipped below last year’s level, indicating that many support-service firms have cut back. The downturn here suggests some secondary impacts of the economic slowdown: as major industries tighten their belts, the contractors and support services that rely on them are seeing reduced demand.

- Scientific and Technical Services: This white-collar sector (professional, scientific, and technical services, including much of tech) has essentially flattened out. Employment in June (around 528,600 jobs) is almost the same as last June, a change of only about +0.1%. Earlier in 2025, this sector experienced slight declines amid tech industry layoffs and cooling investment, but it appears to have stabilized at its current level.

- Finance and Insurance: This sector remains a pillar of growth, though its expansion has moderated. Employment is up about +5.5% year-over-year, reaching roughly 458,000 in June. That’s a healthy increase (continuing a trend of strong momentum) but a slower growth rate than earlier in the year when finance saw double-digit gains. Toronto’s banks and insurers have largely stabilized at high employment levels, and while they’re still adding jobs, the pace has eased as the industry digests economic uncertainties.

- Transportation and Warehousing: This remains the hardest-hit sector. Employment fell about –10% from last year, dropping to roughly 215,700 jobs in June (down from about 239,600 a year ago). This decline is on par with the steep fall seen in May. Toronto’s logistics and transit employers continue to struggle with multiple headwinds. Elevated fuel costs, shifting consumer spending patterns, and the ongoing tariff war have led to cutbacks in trucking, air transport, and warehousing jobs. Freight volumes have been inconsistent, and with international trade flows disrupted, many transportation firms have scaled back. Public transit ridership is also recovering slowly, affecting transit employment. The result is a sector that has shed a significant share of its jobs over the past year. The drop in transportation/warehousing underscores the toll that trade frictions and cost pressures are taking on the movement of goods and people. It is notable as the sharpest percentage decline of any major sector – a clear outlier on the downside.

- Wholesale and Retail Trade: Retailers and wholesalers have seen modest improvement. Employment is up roughly +3.0% year-over-year (about 537,900 jobs in June), a slightly faster growth rate than a month ago. This suggests consumer spending has been a bit stronger than it was in early 2025, allowing for some payroll expansion. Many shops are operating with lean staffing, and while there have been hiring spurts (e.g. for summer sales or new store openings), they haven’t translated into major net gains. Trade employment has inched up, but the future demand highly dependent on consumer confidence going forward.

- Manufacturing: Factory employment is essentially stalled at last year’s level. June’s manufacturing workforce (around 347,700 people) is virtually unchanged (+0% YOY) from June 2024. This marks a significant cooling from the situation a few months ago; as recently as early spring, manufacturing jobs were posting solid year-over-year gains. However, that momentum evaporated in late spring as manufacturers have pulled back, likely in response to the tariff-related issues and softer export demand. Reports of recent layoffs and reduced shifts at some plants align with this flat-lining of factory job growth..

- Construction and Utilities: After months of decline, this sector is showing signs of stabilization. In June, construction and utility employment was actually up about +2.6% year-over-year, at approximately 227,400 workers – a mild turnaround from the –3% YOY drop observed in May. This unexpected uptick could reflect a few large projects ramping up hiring or simply easier comparisons (June 2024 had seen a lull). However, it’s too early to call it a sustained recovery. Toronto’s construction industry is still grappling with the drag of high interest rates and uncertainty around major developments. New housing starts and commercial projects have cooled off since last year, and some planned developments remain on pause. The modest gain in June may indicate that the sector has hit bottom, but going forward, activity will depend on financing costs and confidence.

Overall, Toronto’s job growth is concentrated in services, especially sectors like finance, hospitality, education, and creative industries, which are driving most of the gains. In contrast, goods-producing sectors and those sensitive to trade and interest rates (manufacturing, construction until recently, and transportation) are flat or shrinking. This divergence highlights the uneven nature of the recovery: local-facing service industries are rebounding with consumer activity, while globally exposed and interest-sensitive fields remain under pressure. The hope is that resolving trade disputes and a more predictable economic climate will allow the lagging sectors to pick up. In the meantime, Toronto’s labour market momentum is being carried by its service sector strength, even as it is held back by challenges in other areas.

JobsTO Hiring Activity – Hiring Remains Subdued

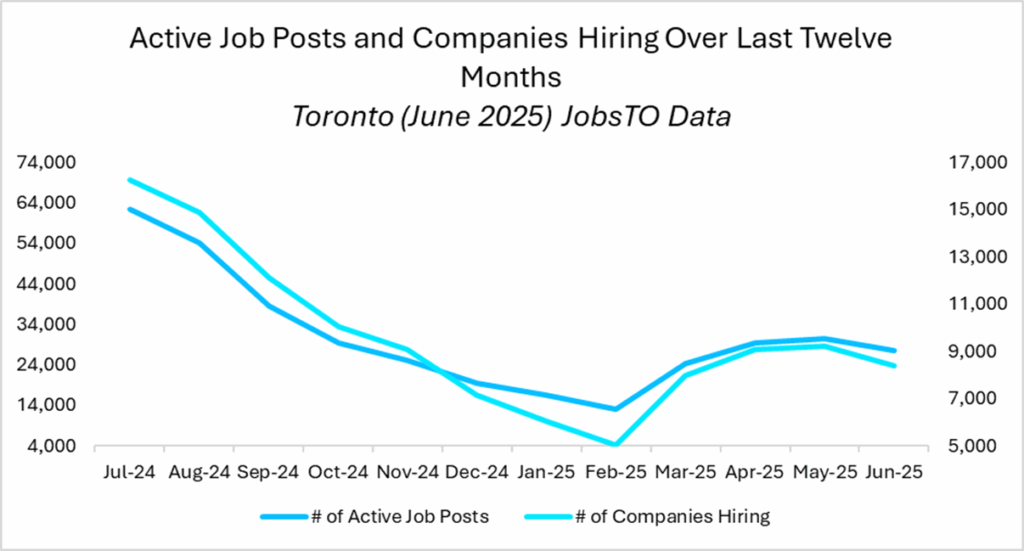

After a brief spring uptick, online hiring activity in Toronto cooled and stayed subdued as we entered the summer. Employers grew more cautious in their recruitment, resulting in significantly fewer new job postings than last year and no major rebound from May’s slowdown.

Job postings remain far below last year’s levels. Active online job postings in the Toronto region totaled roughly just over 20,000 in June 2025, which is on the order of 50% fewer openings than the same time last year (June 2024 saw on the order of 40–45k postings). In other words, employers are advertising only about half as many jobs as they were a year ago, a stark indicator of weakened hiring demand across the city. The number of companies actively hiring has seen a similar drop, as many firms have frozen or scaled back recruitment amid economic uncertainty. This trend of subdued postings was already evident in the spring and persisted into June.

Postings down across all industries. The decline in job ads is broad-based – virtually every sector had far fewer postings this June than last. The sharpest collapse has been in the transportation sector, where postings have plunged by around –75% year-over-year (e.g. logistics and transit job ads have dried up as discussed earlier). Big drops are also seen in construction and utilities (on the order of –60% fewer postings than a year ago), reflecting the building slowdown. Manufacturing job ads are down roughly –55%, aligning with that sector’s flat employment and tariff headwinds. Consumer-facing retail and wholesale trade postings have fallen by about –50% as spending moderates. Even typically resilient white-collar fields are way down: finance job postings are about half of last year’s volume. Public sector hiring online is lower too – education and public administration postings fell –48%. Health care postings, despite the need for staff, dropped –46% (some hiring may be happening through other channels or delayed by funding). Hospitality postings are roughly half of last year (≈–50%), after many restaurants and hotels staffed up last summer. In short, no sector was spared: even the “least affected” industries saw job ads down by nearly half. This across-the-board pullback illustrates an abundance of caution among employers. With trade tensions, higher costs, and an uncertain economic outlook, companies are erring on the side of posting far fewer new jobs than they normally would. The only silver lining is that earlier in the winter, postings were even lower – there was a mild pickup in early spring.

As of June, hiring appetite remains historically subdued. If business conditions don’t improve, this could start to impede future employment growth, since a sustained recovery in job creation typically needs an increase in job postings. For now, all signs point to a very slow summer for recruitment activity in Toronto.

In Other News

Housing Market Stabilizing? Toronto’s housing market showed tentative signs of stabilization in June 2025 after a sluggish first half of the year. Home sales in the Greater Toronto Area were 2.4% lower in June compared to a year earlier (6,243 units sold), a much smaller drop than the double-digit declines seen in April and May. With more choice and leverage, buyers have been able to negotiate prices down. The average selling price across the GTA slipped to roughly $1.10 million, about 5.4% lower than June 2024.

Rental Market Eases for Tenants. Toronto’s rental market continues its tenant-friendly turn that began earlier this year. Average apartment rents have now fallen on a year-over-year basis for roughly six consecutive months, a remarkable reversal after years of rent increases. As of early July, one-bedroom apartments in the city are renting for appreciably less than they did at the peak in late 2024 – in popular downtown areas, average 1-bedroom asking rents are down on the order of $300–$400 from last year’s highs. Estimates put city-wide average rents around 6–7% lower than a year ago. At the same time, supply has improved: the apartment vacancy rate, which was under 2% a couple years ago, has climbed to roughly 3% or higher, the highest in recent memory. New condo completions and a cooler influx of renters (for instance, some reduction in international student arrivals due to stricter study permit rules) have increased availability.

Workforce Training Initiatives: Amid these challenges, there were positive moves on the workforce development front in late June. The Ontario government announced a $2 million investment through its Skills Development Fund to support the Pearson Works training project at Toronto Pearson International Airport. This program will help recruit and upskill about 450 workers for in-demand roles at Pearson – including jobs in hospitality, baggage handling, security, and customer service – directly linking trainees to employers at the expanding airport. The goal is not only to fill needed positions for Pearson’s ongoing expansion, but also to protect workers by equipping them with skills for stable careers amid the turbulence in other sectors.